What SF Buyers and Investors Should Know About Newly Built Homes Right Now

You’ve probably seen the headlines: “New Home Inventory Hits Highest Level Since 2009!” And if you’ve been in real estate long enough, your first thought might be—Are we headed for another crash?

Let’s cut through the noise. In today’s fast-moving market, especially here in San Francisco, it’s crucial to understand what’s really going on before making investment decisions.

This Isn’t 2008 All Over Again

Yes, new home inventory is up nationwide. But no, this isn’t a repeat of the 2008 housing crisis.

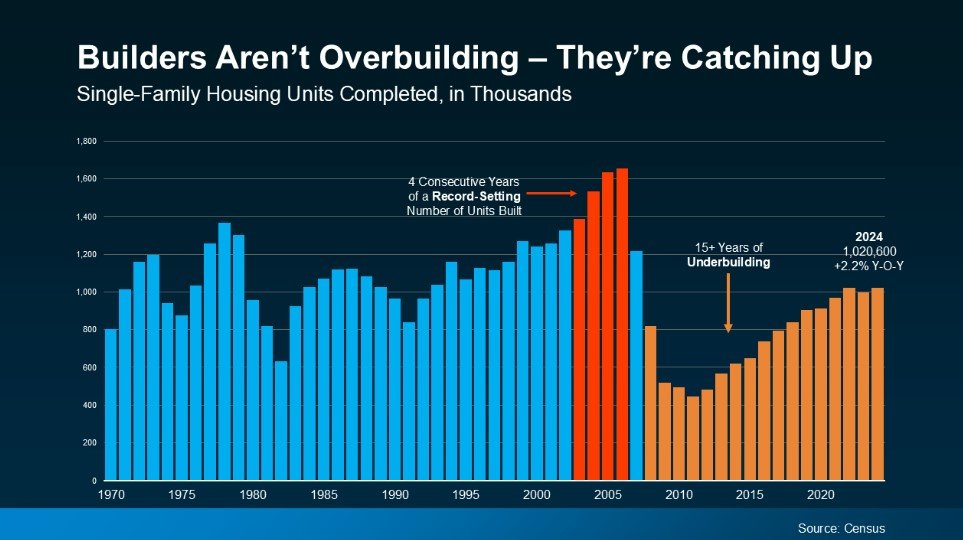

Back then, the market was flooded with excess inventory due to years of speculative overbuilding. Builders were cranking out homes at a pace far beyond what the market could absorb. When the bubble burst, the consequences were severe.

Today, we’re in a very different situation. Builders have actually been underbuilding for over a decade. After the crash, construction slowed dramatically and never quite caught up. In fact, San Francisco—known for its notoriously limited housing stock and challenging permitting environment—has seen even slower new home development relative to demand.

Now that construction is picking up again, it’s not about oversupply. It’s about catching up.

What This Means for San Francisco Buyers and Investors

For local buyers and investors, this uptick in new construction should be viewed as a positive shift—not a warning sign. San Francisco remains one of the most supply-constrained markets in the country. Even with current developments in places like Mission Bay, Dogpatch, and South of Market, we’re still not building fast enough to meet long-term demand.

Here’s what matters:

More new builds = more options in a historically tight market.

High-quality new construction often means better energy efficiency, higher rents, and lower maintenance costs for investors.

Strategic opportunities exist in up-and-coming neighborhoods seeing revitalization—think parts of Bayview, Potrero Hill, or even Treasure Island.

And if you’re in construction or development? These trends are creating smart entry points to build in a city where housing is a long-game investment.

Local Context: Construction Is a Sign of Strength

Look at the local numbers—housing prices in San Francisco remain among the highest in the nation. But with interest rates stabilizing and buyer interest returning, we’re starting to see more activity, especially in the luxury condo and new development space.

This is where your opportunity lies. Whether you’re thinking of investing in a new build for rental income, buying a luxury primary residence, or planning your next project—new construction isn’t the risk the headlines make it out to be. It’s actually a sign of long-term market health.

Final Thoughts

In San Francisco, new construction isn’t oversupply—it’s overdue. If you’re considering buying or investing in a newly built home, you’re not late to the party. You’re getting in while inventory is finally catching up to demand.

Let’s talk about where the smartest opportunities are—whether it's a high-rise downtown, a modern build in Noe Valley, or a long-term play in an emerging neighborhood. Real estate is still one of the best ways to build generational wealth in San Francisco.