Expert Forecasts for San Francisco’s 2025 Housing Market

If you’re thinking about buying or selling property in San Francisco, it’s important to understand where the market is heading. With insights from leading experts, here’s what you can expect for 2025, particularly in the city’s dynamic real estate environment. We’ll focus on two key factors shaping the year ahead: mortgage rates and home prices.

Will Mortgage Rates Drop in 2025?

Mortgage rates are always a hot topic for buyers and investors. While rates are projected to ease slightly in 2025, don’t expect a return to the historically low levels of 3-4%. According to Lawrence Yun, Chief Economist at the National Association of Realtors (NAR):

“Are we going to go back to 4%? Per my forecast, unfortunately, we will not. It’s more likely that we’ll go back to 6%.”

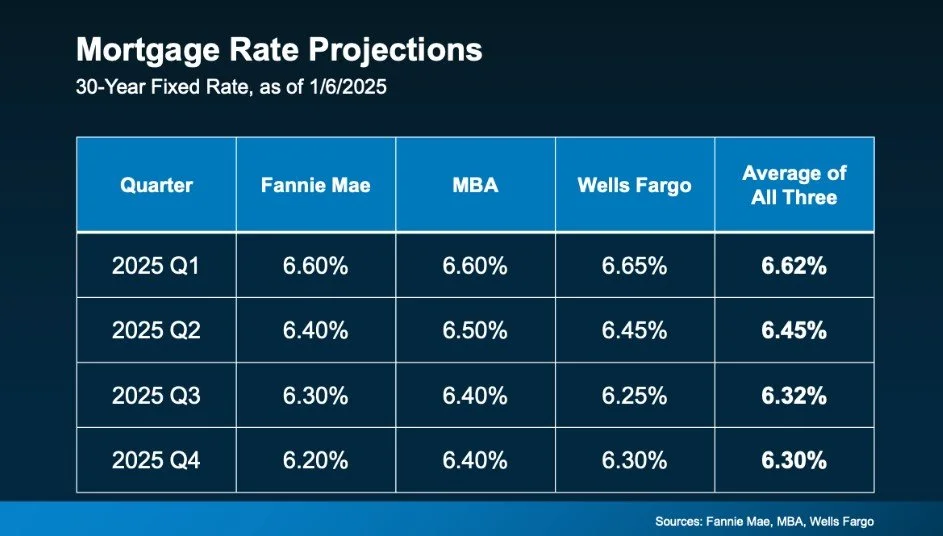

Other experts agree, forecasting rates to settle in the mid-to-low 6% range by the end of 2025. In San Francisco, where luxury properties often come with larger price tags, even small changes in rates can impact affordability and monthly payments.

Instead of trying to time the market perfectly, focus on the big picture and what you can control. For instance:

Work with a trusted lender to explore options for locking in competitive rates.

Partner with a real estate expert who understands San Francisco’s unique housing market dynamics. Even slight rate adjustments can influence your purchasing power, and timing your move strategically could save thousands in the long run.

What’s Happening with Home Prices?

San Francisco’s housing market remains competitive, and experts predict home prices will continue to rise, albeit at a slower and more sustainable pace. Nationwide, prices are expected to increase by about 3% on average in 2025. Locally, San Francisco’s constrained housing inventory and consistent demand may push appreciation rates higher than the national average.

This sustained growth reflects a key trend: limited supply versus high demand. While more inventory may hit the market in 2025, it’s unlikely to meet the robust buyer demand, especially for well-located or recently renovated luxury properties.

“Prices will rise at a pace similar to that of the second half of 2024 because we don’t expect there to be enough new inventory to meet demand.”

For buyers, this means acting sooner could save you from paying more later. For sellers, it’s an opportunity to maximize your return in a market that values long-term equity.

San Francisco Market Considerations

The San Francisco market offers unique challenges and opportunities:

Neighborhood nuances: Areas like Nob Hill, Hayes Valley, and Telegraph Hill continue to attract interest for their luxury offerings, strong investment potential, and lifestyle appeal. However, some neighborhoods may experience slower growth depending on inventory levels.

Construction insights: Properties with room for improvement or value-add potential, like adding an ADU or updating interiors, may offer higher long-term returns. This is especially true in San Francisco, where buyers often seek high-end finishes and functional spaces.

Investment opportunities: Investors can benefit from buying in neighborhoods poised for growth or with lower entry points, then leveraging appreciation as demand continues.

Bottomline

San Francisco’s housing market is poised for steady appreciation, with mortgage rates easing slightly but remaining in the 6% range. Whether you’re a buyer or seller, staying informed is key to making a smart decision in this competitive market.

Let’s talk about how these trends impact your real estate goals. Whether you’re looking for your next home or investment property, I can help you navigate the market, evaluate opportunities, and build long-term wealth through real estate in San Francisco. Contact me today to get started.