Lets work together!

charlie@charliebrownsf.com

415-722-3493

Welcome to our Blog!

Why Pre-Approval Is a Must for San Francisco Homebuyers This Spring

If you’re thinking about buying in San Francisco this spring, getting pre-approved is your first move. It helps you define your budget, strengthens your offer, and positions you as a serious buyer in one of the most competitive markets in the country.

Want to discuss your options? Let’s connect and strategize how to find the best opportunities in SF’s ever-evolving real estate landscape.

Buying Your First Home in San Francisco? It’s Normal to Feel Nervous

Buying your first home in San Francisco can feel overwhelming, but it’s also a smart long-term investment. If you’re financially prepared, don’t let fear hold you back. The right strategy, paired with expert guidance, can set you up for success in this competitive market.

Have questions about buying your first home in SF? Let’s talk and create a plan that works for you.

Mortgage Rates Drop: Now Might Be the Time to Invest in San Francisco Real Estate

Mortgage rates are currently more favorable, giving you room to make a move in the competitive San Francisco market. If you've been waiting for the right time, this may be the window you've been looking for.

Would a lower monthly payment make purchasing your next investment property or dream home feel more attainable? Let’s break down the numbers and explore your options—whether you’re looking for a luxury condo, multi-unit investment property, or your next family home in San Francisco. Reach out today to discuss how you can capitalize on this market shift.

Is an Accessory Dwelling Unit (ADU) a Smart Investment in San Francisco?

An ADU can be a great investment in San Francisco, providing rental income, increasing your home’s value, and offering flexible living solutions. If you’re considering adding an ADU or purchasing a property with one, let’s discuss your options and how to maximize your investment.

Interested in exploring ADUs in San Francisco? Reach out today for expert guidance on the best opportunities in the market.

How to Buy a Home in San Francisco Without Waiting for Lower Rates

Waiting for mortgage rates to drop significantly might not be the best approach—especially in a city where real estate values continue to climb. Instead, consider strategies like buydowns, ARMs, or assumable mortgages to make homeownership more affordable today.

If you're thinking about buying in San Francisco this year, let's talk about your options. Whether you're looking for an investment property, a luxury condo, or a single-family home, there are ways to structure your financing that work in your favor.

📩 Contact me today to explore the best opportunities in SF real estate!

Why Pricing Your San Francisco Home Correctly Matters

In San Francisco’s competitive real estate market, overpricing can cost you time, money, and opportunities. If the price isn’t compelling, it won’t sell.

Let’s work together to set the right price and make sure your property attracts serious buyers. Ready to get started? Contact me today to list your San Francisco property and achieve your real estate goals.

Mortgage Forbearance: A Valuable Option for San Francisco Homeowners Facing Financial Struggles

If you’re facing financial challenges, don’t wait. Reach out to your lender to explore your options and keep your real estate investments on track. With the right approach, you can protect your assets and position yourself for long-term financial stability.

For more insights on real estate investment, market trends, and managing your property in San Francisco, visit CharlieBrownSF.com. Let’s work together to make smart, strategic decisions for your future.

More Starter Homes Are Hitting the Market in San Francisco

Starter homes are re-emerging in San Francisco, creating opportunities for both first-time buyers and investors to enter the market. Whether you’re looking for your first home or your next smart investment, let’s connect. I’ll help you identify the best options, evaluate their potential, and guide you through every step of the process.

When Will Mortgage Rates Come Down in San Francisco?

If you’re looking to buy or invest in San Francisco real estate, staying informed about mortgage rate trends is important—but it shouldn’t hold you back from moving forward with your plans. Rates are expected to ease, but no one knows exactly when. The key is to focus on what you can control right now and work with a trusted real estate agent who understands the intricacies of the San Francisco market.

Let’s connect to discuss your options and how these trends impact your next move.

Why Today’s Mortgage Debt Isn’t a Sign of a Housing Market Crash in San Francisco

While mortgage debt has reached all-time highs, the San Francisco housing market isn’t headed for a crash. Homeowners today are in a much stronger financial position thanks to high equity levels, low unemployment, and support programs that help prevent foreclosures.

For real estate investors, these factors create a more stable market with opportunities for long-term wealth building. Whether you’re looking to buy a luxury property, invest in rental properties, or capitalize on new construction projects, the San Francisco market continues to offer great potential.

If you have any questions or want to discuss the current real estate climate in San Francisco, let’s connect. I'm here to provide insights and help you navigate investment opportunities in this dynamic market.

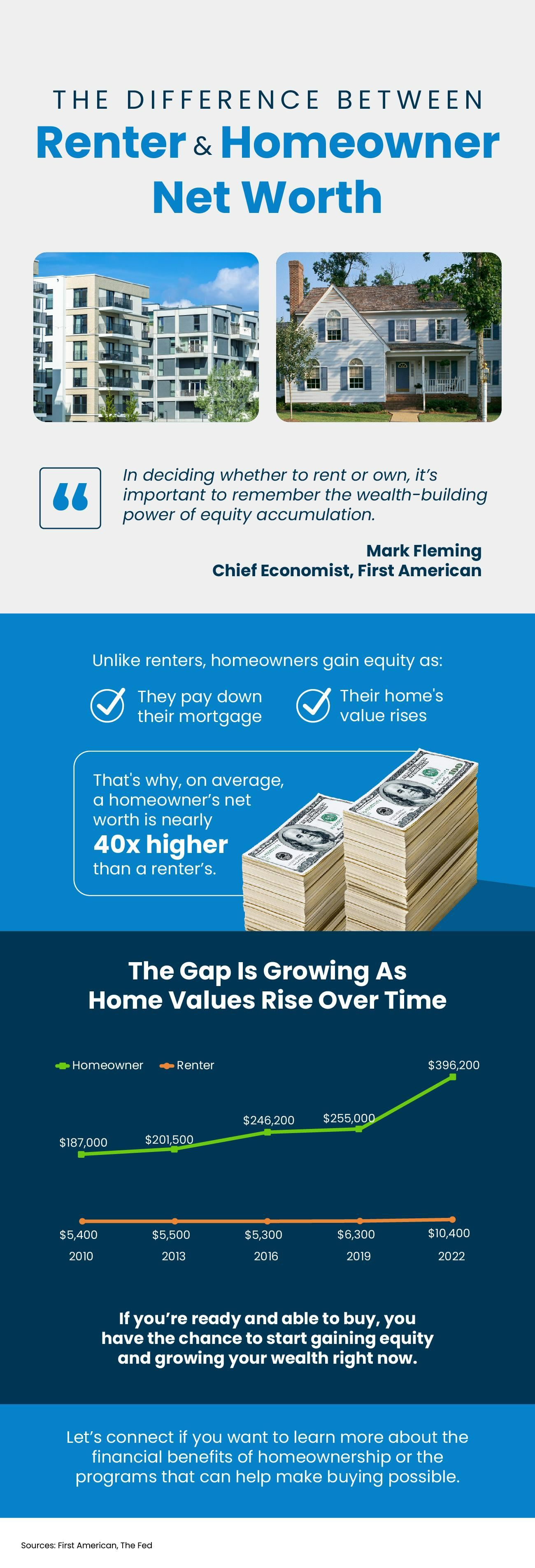

The Big Difference Between Renter and Homeowner Net Worth

If you’re torn between renting or buying, don’t forget to factor in the wealth-building power of homeownership. Unlike renters, homeowners gain equity as they pay their mortgage and as home values rise. That’s why, on average, a homeowner’s net worth is nearly 40x higher than a renter’s. Let’s connect if you want to learn more about the financial benefits of homeownership or the programs that can help make buying possible.

Unlocking the Power of VA Loans for San Francisco Veterans

If you’re a Veteran thinking about buying a home in San Francisco, leveraging a VA loan could be your best route to homeownership. It’s an often-overlooked benefit that can make a substantial difference, especially in a high-cost market like ours. Let’s connect to discuss how you can use this powerful resource to secure your piece of San Francisco real estate.